Bordeaux Greed meets Chinese Affluence

This is a great documentary, for both old and newer hands at wine. The story is about wine and about politics – those of the great chateaux of Bordeaux, and the investors that drive the prices up, and the Chinese who’ve displaced the Americans to become the biggest market for the premier grand crus.

Unlike Mondovino, which is fascinating but wanders off in all kinds of directions, Red Obsession keeps a tight focus on Bordeaux and its big brands: Petrus, Lafite, Latour, Margaux, Haut-Brion and Mouton-Rothschild. The doco is just 80 minutes long and was made by David Roach and Warwick Ross (Young Einstein, Reckless Kelly). Andrew Caillard of Langton’s Auctions (now owned by Woolworths) is the associate producer, and a frequent contributor of insights.

Wine as investment

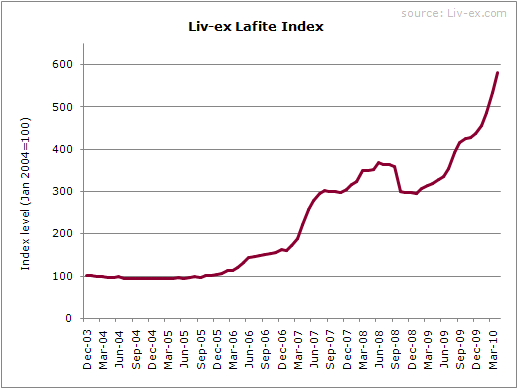

In the late eighties, the prices of great Bordeaux reds and whites began their relentless rise. American brain surgeons and investment bankers were the driving forces back then, and some wealthy businessmen from Hong Kong. In the first decade of the naughties, Premier Grand Cru Bordeaux attracted ever more investors as Bordeaux outstripped even the overheated stock market.

That’s a 5-fold gain in just 7 years. Putting some real numbers against the curve, we find that Lafite, Latour et al fetch around $1000 to 1500 a bottle for current release wines, and Petrus and Le Pin (highly fancied Pomerols) up to $4000 a bottle. Older wines from top vintages fetches more again. 1982 was the last ‘vintage of the century’ before 2009, and 1961 the previous one (they have a few of these every century).

A regular group of us had a few of these at one of our dinners last year, contributed by one of our generous members. Probably close to $10,000 sitting on the shelf here. Are these wines worth that kind of money? Of course not. IMHO, no wine is worth more than $100 – 200 a bottle. Whatever the label says, and whatever the auctioneers say in their catalogues, it’s only fermented grape juice.

A regular group of us had a few of these at one of our dinners last year, contributed by one of our generous members. Probably close to $10,000 sitting on the shelf here. Are these wines worth that kind of money? Of course not. IMHO, no wine is worth more than $100 – 200 a bottle. Whatever the label says, and whatever the auctioneers say in their catalogues, it’s only fermented grape juice.

The top wines of Bordeaux have more in common with Ferrari cars, Rolex watches and Haute Couture. The only difference is that you can’t just make more Petrus because the market wants more. Something has to give so the price shoots up. Still, the bigger Bordeaux labels are marketed with great skill and no expense spared.

No matter how much their owners talk about growing grapes, tending vineyards, making wine and the love and care that goes with that, these are luxury brands, not wines. They’re collected and shown off, not drunk. They make great gifts in the right circles, and great investments.

No matter how much their owners talk about growing grapes, tending vineyards, making wine and the love and care that goes with that, these are luxury brands, not wines. They’re collected and shown off, not drunk. They make great gifts in the right circles, and great investments.

As the London broker in the doco says: investors buy cases of these wines, sight unseen. They don’t know or care what the cases look like, let alone the labels. Most of our Grange is bought to impress business partners and friends, and as an investment. Grange passes many hands, but not many lips. Sadly, Grange is not the investment its makers would have us believe, let alone comparable to the big Bordeaux brands. More on that here: Penfolds Grange – rich wine, poor investment .

China to the rescue

How convenient, the owners of the big Bordeaux brands must’ve thought when American investors abandoned them when the GFC hit home and the Chinese took up the slack. Red Obsession charts that new obsession of wealthy Chinese business people and aspirants to the finer things in life. Lafite etching the lucky numeral 8 into its bottles from that vintage was a marketing master stroke.

The 2009 vintage was declared a vintage of the century, and prices went through the roof. The Chinese market didn’t seem to care. Then the experts – Parker, Robinson et al – declared the 2010 vintage another VOTC, pushing prices further up. Then came a problematic 2011, and the bubble burst. Chinese wine enthusiasts and investors alike have no historic connection with Bordeaux, and can easily switch their enthusiasm and their money to other attractions.

The Sting in the Tail

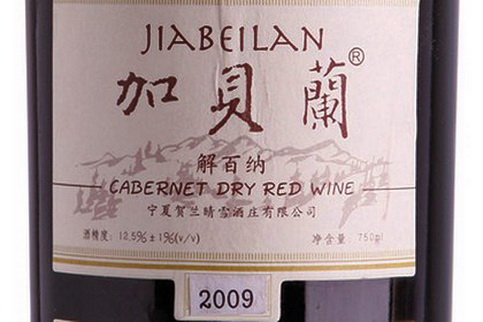

The Chinese are also resourceful , and have planted vineyards of their own. Don’t laugh: in 2011, they took out the international trophy for best Bordeaux varietal over £10 ($A15) at the Decanter World Wine Awards.

The Sydney Morning Herald reported that ‘Zhang Jing and Li Demei, her consultant winemaker at the He Lan Qing Xue vineyard in the mountainous Ningxia province of China, triumphed not just over France but the rest of the world this week … It is the first time a Chinese wine has won this coveted prize, and it is bound to create a stir around the proud chateaux of Bordeaux, who are happily getting used to the idea of China as a deep-pocketed marketplace for their own wine.

Current table wine consumption (made from grapes) in China is one bottle per person per year. In western countries, it’s 35. As consumption in China grows, the entrepreneurs tell us that China will become the biggest wine producer in the world. By that time, we can safely assume that the owners of the big Bordeaux brands will have found new markets for their wares (Russia, Brazil?).

Red Obsession is well worth seeing: it’s beautifully made and filmed, tightly scripted, narrated by Russell Crowe, and full of insights.

Kim